Building The Wealth Of Nations

Women Building Wealth

Female entrepreneurs make up approximately a third of all entrepreneurs globally. According to one study, in 2012 approximately 126 million women were either starting or already running businesses in various economies all over the world.

These women are not just running their own businesses, but they are also employers of labour. This means they are actively participating in the growth of their economies, and helping to build the wealth of their nations.

Women Need Business Financing

Sub-Saharan Africa has the highest number of female entrepreneurs, with about 27% of the female population.

However, even with the availability of technology and the support from different organisations, female entrepreneurs today are still struggling, and financing remains the biggest obstacle they face.

Women Empowering Women

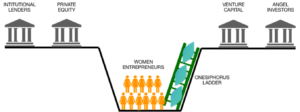

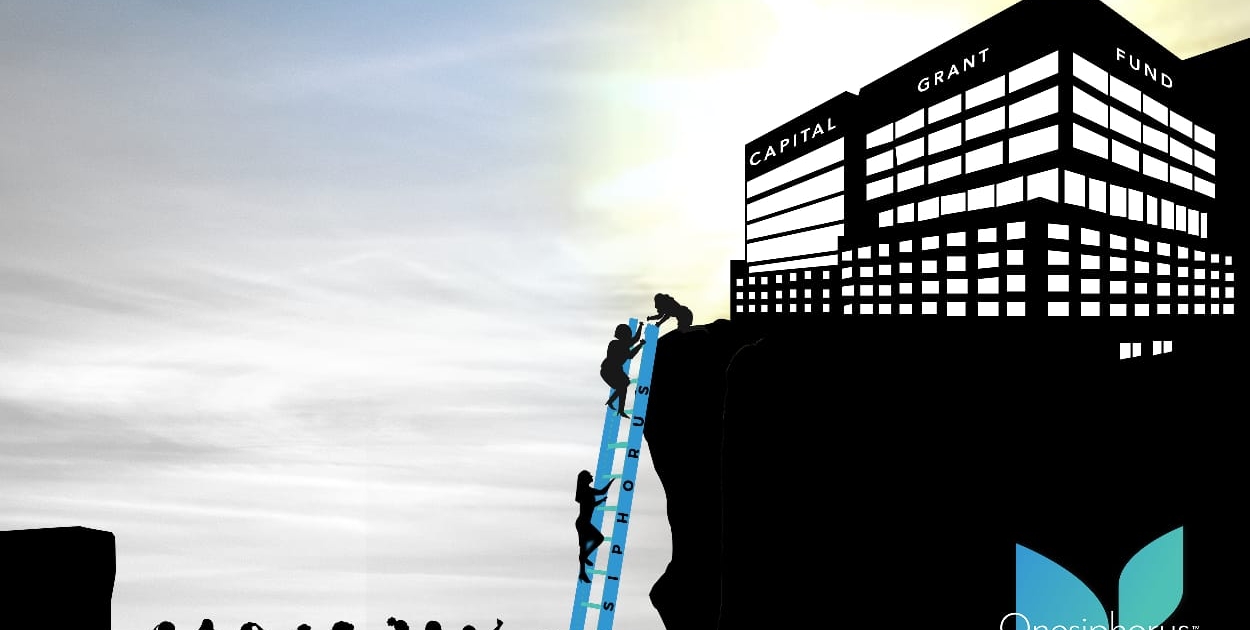

Onesiphorus is a female-led organisation driven by a single vision — the economic empowerment of women in Sub-Saharan Africa. We seek to advance women’s wealth creation by developing and delivering superior financial solutions.

Our mission is to provide the ladder that lifts the female-owned businesses to true profitability and sustainability, using a set of unique service offerings entrepreneurs can leverage to become bankable.